Strategy Name: Debit Iron Fly (Debit Spread both Call & Put)

Instrument & Other Info:

- FINNIFTY Index. Trade Date: 16/1/2024 (weekly expiry day)

- Trade Entry Time: 9:45AM (within 30 minutes of Market Open). FINNIFTY at the Time of Entry: 21456

- Return on Investment: Very good for a day. Always from 1.5% up to 2% (when max profit hits)

Objective of this Trade:

Generally, expiry day is quite volatile, hence losing money on the expiry day is very common. At the same time, it also offers a lucrative opportunity for profit if planned & executed properly. The objective is to take advantage of this opportunity by executing a strategy consistently that generates profit over the time after executing a number of trades.

Risk/Reward:

On the face risk versus reward is not good. For this Strategy, it will be never good on the day of expiry. In this current trade risk is almost double the reward. However, Probability of Profit (PoP) is always very high, generally 75% and above.

One Minute Chart Reading:

- Last few days price is in a range of 21000 to 21600.

- Price closed around 21460 on 15-Jan, leaving very little room for upside.

- Multiple Doji candles around top since 15-Jan, indicating further upside uncertainty.

- Ichimoku cloud is flat, also Tanken Sen & Kijun Sen line are flat, giving a range bound view.

- The Broad market index (Nifty) is bullish with less momentum (refer ROC) indicator.

Decision for Action:

Based on the above observation and the current market situation, this strategy may not be the best. Option. However, following the systematic trading approach and risk management consideration, it is better to take half the usual position size. My usual position size is 20 Lots, here I will go for 10 lots.

Trade Entry Action:

– Buy ATM strike 21450 for both Call & Put

– Sell OTM strike 21500 for Call & strike 21400 for Put

– No of Lot = 10

Exit Strategy:

- Monitor the price action till 2PM.

- In case there is no move on either side and price is hovering around Call/Put Buying price then exit the trade and book the current loss.

- Avoid holding the trade till End of Day and take the max loss.

- In case of price moving up/down wait and let it expiry or exit little before market closes.

FINNIFTY Daily Chart at the Time of Trade entry:

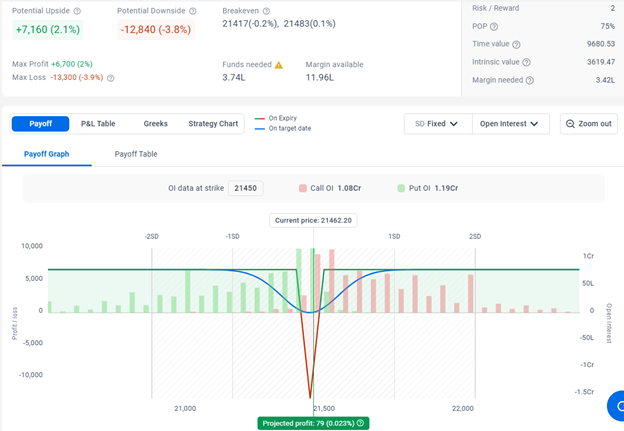

Initial Pay-Off Chart at the time of Trade Entry:

Nifty Daily Chart (Market Index) at the time of Trade Entry:

Observation at 2 PM:

Sideways moves continue in zigzag form in a range of 21510 & 21418. Net loss is increasing as the time passes by. No concrete move in price is noticed. At 2 PM, the price is around 21450, so it is time to close the trade otherwise loss amount will increase. Refer the Pay-off at 2pm

Pay-off Chart around 2 PM:

Booked the Loss of INR 4820 for 10 lots of FINNIFTY in this expiry around 2 PM. Refer to the picture below.

Final observation after Market Close:

Price forms a near perfect Doji at the close of the market (refer to the chart below). FINNIFTY opened at 21444.05 & closed at 21447.15

So, in this case waiting till market close/expiry without any action would have increased the Loss heavily.

FINNIFTY Daily Chart after market close on 16-Jan-2024