Options Characteristics to consider for Profitable Trading

Leverage: Allows a trader to control a large position with relatively small investment

Flexibility: Offer a wide range of strategies to manage various market conditions

Risk Management: Traders can hedge their existing positions to limit potential losses

Income Generation Strategy: Few strategies can generate income in addition to capital gains

Limited Risk, Unlimited Reward: Risk-Reward profile is distinct for certain option strategies

Volatility Trading: Strategies can be implemented to capitalize on market volatility

Time Decay: Options have a finite lifespan, and their value erodes over time specially OTM

Liquidity: Some contracts are highly liquid; entry & exit has minimal impact on P&L

Derivative Nature: Options provide a way to gain exposure to an asset without owning it

Complexity: Option is complex compared to other asset class, needs deep knowledge

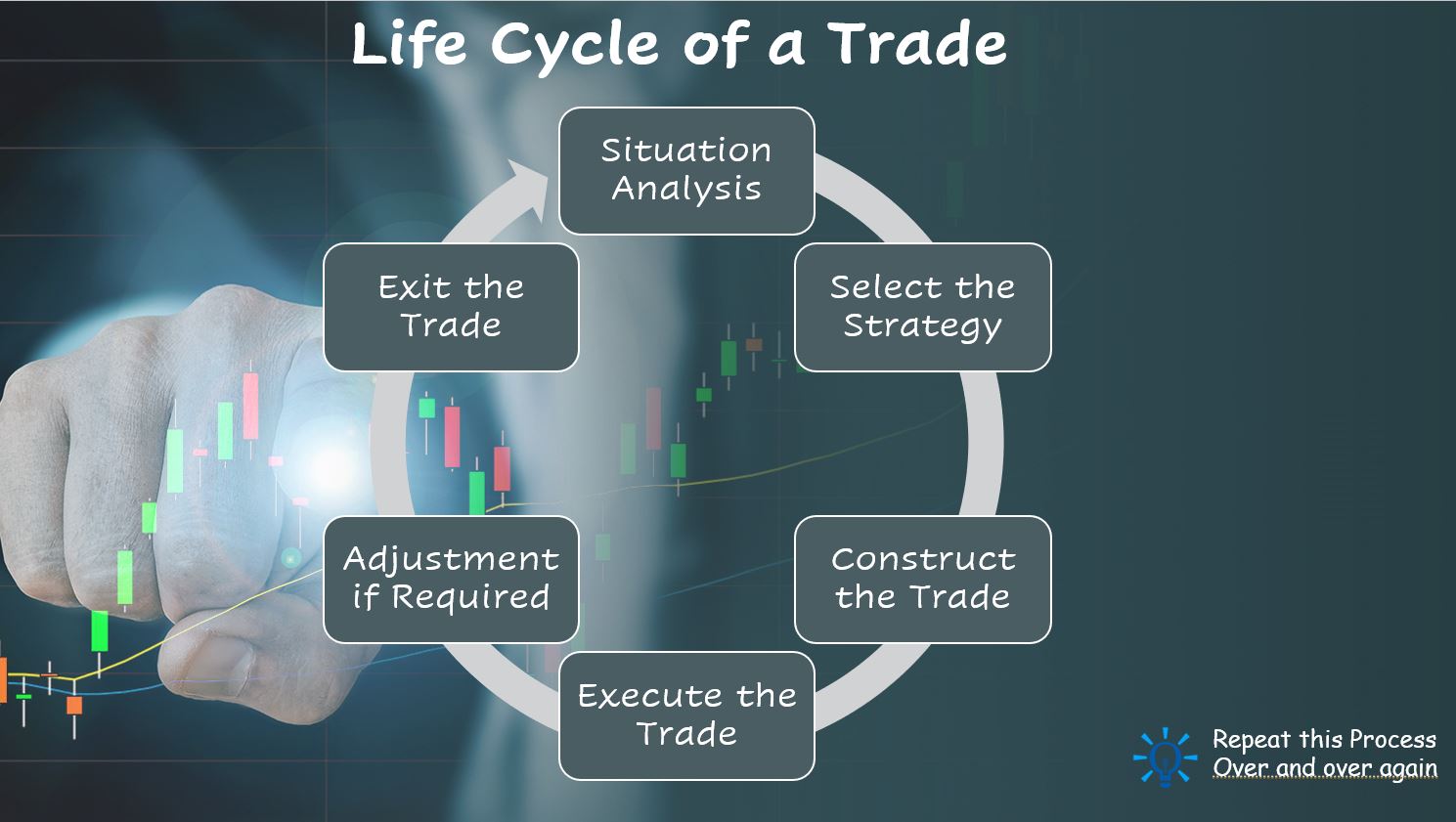

Typical Life-Cycle in an Option Trade

- Analyze current Market Situation

- Choose an Appropriate Strategy

- Construct & Check the Pay-off Diagram

- Execute & Monitor the Trade

- Make Adjustments as per Plan

- Exit the Trade as per pre-defined Crieteria

Broad Market Index Analysis - NIFTY

- Analyze the Global Market Situation

- Follow the Activities of Domestic & Foreign Instituitional Investors

- Take note of Economic Data & related News

- Keep Track of Derivative Data

- Follow the Events & Results of Corporates

- Keep Track notices of Central Bank & Exchange Regulators

Trading Strategies - Bullish Market Situation

- Short Term Market View is Bullish

- Choose Strategies for High IV situation

- Look for Strategies for Low IV situation

- Check Strategies for Medium IV situation

Trading Strategies - Bearish Market Situation

- Short Term Market View is Bearish

- Choose Strategies for High IV situation

- Look for Strategies for Low IV situation

- Check Strategies for Medium IV situation

Trading Strategies - Range Bound Market

- Short Term Market View is Range Bound

- Choose Strategies for High IV situation

- Look for Strategies for Low IV situation

- Check Strategies for Medium IV situation

Trade Exit Strategy

- A Pre-determined RoI % of the selected Strategy

- Define a % of Max Profit of the Strategy, e.g. 30%

- Market View absolutely gone wrong, better to exit

- Trade has lost it’s Edge/USP due to situation change