Customized Training & Mentoring

Welcome to our customized Training and Mentoring Program specially designed for you. We have three categories based on the profile of the participants as explained below:

ANKUR (Designed for Beginners) : Those who are new and really interested to learn & step into the Stock Market Trading & Investing

DASABHUJA (Specially Designed for Homemakers) : Homemakers interested to learn & earn to contribute financially in their family

NIPUN (Meant for regular market players) : Part & full time Traders who want to enhance their skills to the next level and become “Unconscious Competent” in this game

Interested? Contact @ support@stocktrading4u.com

Details of each Training Category

Duration: Total 16 Sessions, weekly 2 sessions. Each session 90 Minutes. Group Discount: Available up to 25% for a group of 5 and above

Training Method: Online meeting (Zoom/Google Meet). Interactive through Audio, Video, Q&A. Timing: Flexible

Basic Outline of the Training:

- Introduction to Financial Markets

– Understanding the stock market and its role in the broader financial ecosystem

– Explaining the concept of securities, stocks, broker, DP and exchanges

- Market Mechanics and Operations

– How the stock market functions. Buy/Sell, order types, trading hours, and market participants

– Overview of market indices and their significance including global markets

- Fundamentals of Investing

– Introduction to investment vehicles: stocks, bonds, ETFs, and mutual funds

– Explaining risk and return, diversification, and asset allocation

- Market Analysis and Research

– Basic principles of fundamental and technical analysis

– Resources and tools for conducting market research

- Investment Strategies for Beginners

– Long-term investing vs. trading: pros, cons, and limited risk strategies

– Introduction to value investing, growth investing, and other strategies

- Risk Management and Portfolio Building

– Understanding, identifying and managing investment risks

– Building a diversified investment portfolio based on individual goals and risk tolerance

- Psychology and Discipline in Trading

– Understanding the importance of emotional discipline in trading decisions

– Setting up realistic expectations and managing emotions during market fluctuations

- Regulations and Ethics

– Overview of market regulations, insider trading, and other ethical considerations

– Understanding the role of regulatory bodies (e.g. SEBI) in ensuring market integrity

- Practical Application and Case Studies

– Application of learned concepts through case studies and real-life examples.

– Simulated trading exercises to apply knowledge in a controlled environment

- Resource Guidance and Next Steps

– Curated list of resources for continued learning

– Guidance on further steps for continued growth in stock market trading and investing

Duration: Total 20 Sessions (for absolute beginners) Total 10 Sessions for others. Weekly 2 sessions. Each session 90 Minutes.

Group Discount: Available up to 25% for a group of 5 and above

Training Method: Online meeting (Zoom/Google Meet). Interactive through Audio, Video, Q&A. Timing: Flexible

Customization: Mentoring to develop a Trading System and help taking independent trading decisions for consistent profit

Outline of the Training: Similar to “ANKUR” with appropriate and additional changes, includes derivatives (Stock & Index Options)

Duration: Total 10 Sessions, weekly 1 session. Each session 90 Minutes. Group Discount: Available up to 25% for a group of 5 and above

Training Method: Online meeting (Zoom/Google Meet). Interactive through Audio, Video, Q&A. Timing: Flexible

Customization: Mentoring to develop a Trading System and help taking informed decisions for consistent profit

Outline of the Training:

- Advanced Options Fundamentals

– In-depth study of complex & advanced options strategies

- Advanced Greeks and Option Sensitivities

– Clear understanding of Delta, Gamma, Theta, and Vega

– Leveraging Greeks in constructing & adjusting advanced options strategies

- Volatility Analysis and Trading

– Advanced volatility concepts: historical vs. implied volatility

– Strategies for trading volatility, including volatility skew and term structure

- Hedging and Risk Management Strategies

– Advanced techniques for hedging using options

– Risk mitigation strategies for a portfolio

- Event-Driven Trading Strategies

– Strategies around earnings announcements, mergers & acquisitions, and other corporate events

– Leveraging options in event-driven scenarios for maximum advantage

- Algorithmic Options Trading

– Understanding the possibilities of algorithmic trading in options

– Designing and implementing algorithmic strategies for options

- Option Trading as a Business

– Analysing advanced options strategies for consistent income generation

– Application of strategies in various market conditions and scenarios

Stock Trading: (Master Class)

- Total 6 Sessions, weekly 1 session. Each session of 150 Minutes.

- Online meeting (Zoom/Google Meet). Interactive through Audio/Video, Q&A.

- Proven techniques and strategies for consistent income generation with Risk Management.

- Mentoring and support (in Live Trading) for next THREE months after completion of Master Class.

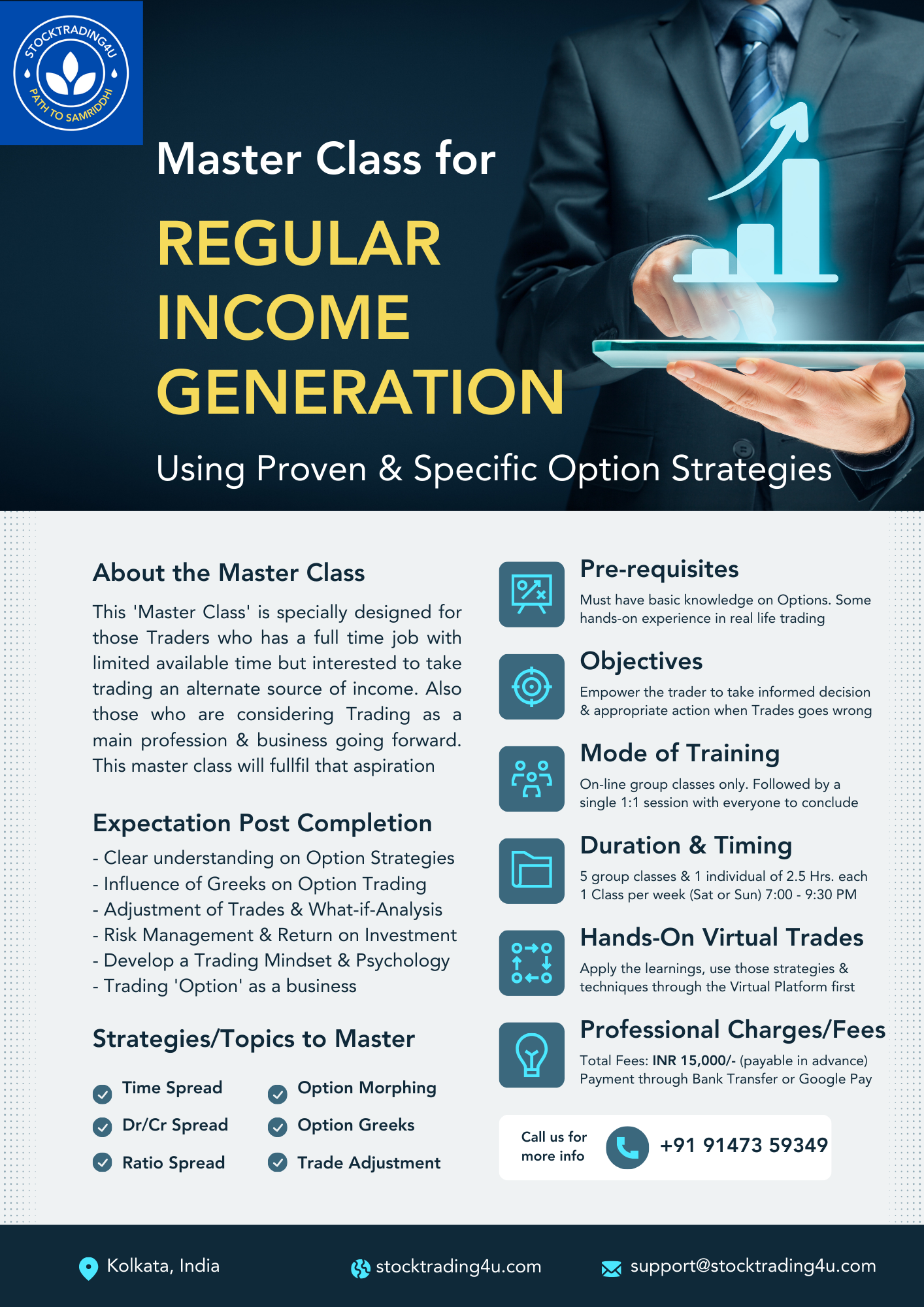

Option Strategies: (Master Class)

- Total 6 Sessions, weekly 1 session. Each session of 150 Minutes.

- Online meeting (Zoom/Google Meet). Interactive through Audio/Video, Q&A.

- Proven techniques and strategies for consistent profit with hedging, for all market conditions.

- Covers multiple Adjustment Techniques for each Strategy when a trade goes against the expectation.

- Mentoring and support (in Live Trading) for next THREE months after completion of Master Class.

Currency Trading (USD/INR): (Master Class)

- Total 4 Sessions, weekly 1 session. Each session of 90 Minutes.

- Online meeting (Zoom/Google Meet). Interactive through Audio/Video, Q&A.

- Proven techniques and strategies for consistent income generation with Risk Management.

- Mentoring and support (in Live Trading) for next THREE months after completion of Master Class .